Credit Union Advocacy

Credit Union Day at the Capitol 2025

February 11, 2025 - Together, we're making a difference by building relationships with lawmakers and speaking up on issues that affect our members and communities.

The Cornerstone League welcomed more than 70 credit union leaders from 19 different credit unions into the Jefferson City Capitol for the annual Day at the Capitol event.

The day included an impressive 106 appointments with legislators as well as attending a hearing where a representative from the Missouri Credit Union Association testified in support of the Trusted Contact Anti-Fraud Bill.

Advocacy Priorities

America's Credit Unions stands for and fiercely provides forward-thinking advocacy to secure policy wins that allow credit unions to thrive. They make sure policymakers and regulators know why credit unions are the best financial services choice for Americans.

- Protect credit unions from attacks on tax status, addressing data security needs, challenging big bank encroachment, fighting for regulatory oversight of developing industries, and tackling overzealous regulatory burdens.

- Empower consumers with services that help them manage their finances.

- Advance the credit union movement through right-sized legislation & regulations.

The Value of Credit Unions

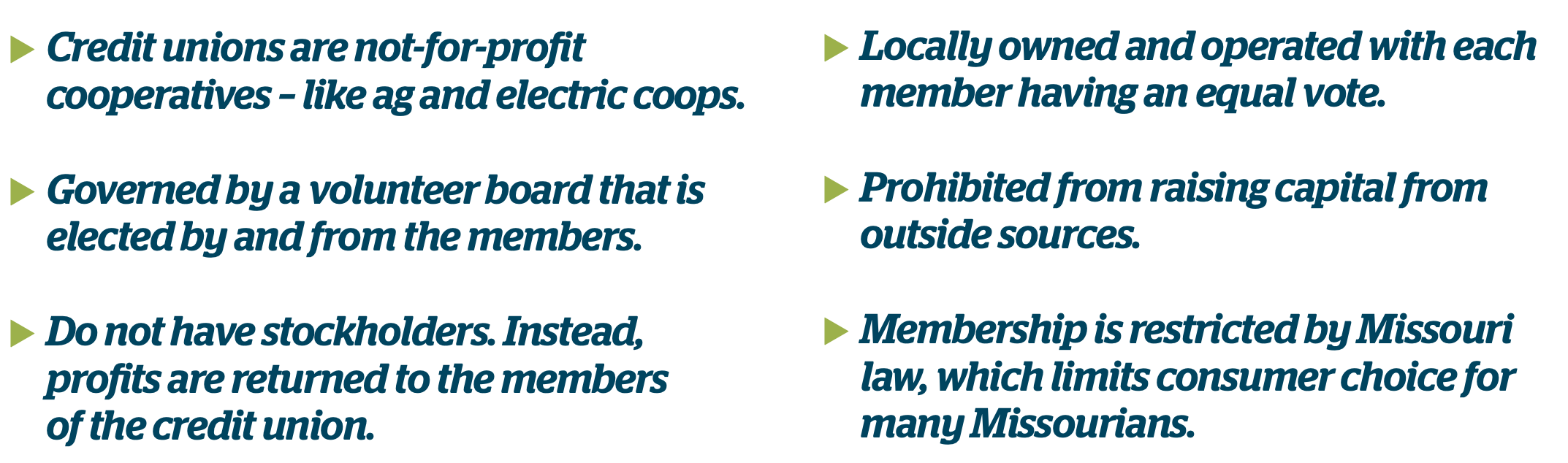

Credit unions are not-for-profit financial cooperatives. No matter the size or what services a credit union offers – its structure remains the same with a focus to serve consumers and give them a financial choice. This focus on consumers benefits the entire community and financial services, including those who are not credit union members. Other distinctions include:

Protect Consumer Choice in Missouri's Financial Market

Missouri credit unions play a significant role in driving the growth in the Missouri economy, with more than $10 billion in loans to families, farmers and small business owners. Credit unions are not-for-profit cooperatives, like ag and electric coops, who provide consumers with an alternative for their lending and savings needs while filling a gap in services that other financial institutions may be unable or unwilling to provide.

Helping people in our communities achieve financial success is a priority for credit unions. Last year, local credit unions returned $220 million in profits back to Missourians. Credit unions in our state also made 83,042 low credit score loans and 21,054 small dollar loans, provided 67,759 people with financial counseling and 48,140 loan deferments, and generated nearly 12,000 jobs in Missouri.

Missouri credit unions are restricted by Missouri law on who they can serve. These restrictions limit consumer choice and reduces competition in the marketplace. We urge Missouri lawmakers to support credit unions, including access to not-for-profit credit unions for Missourians across the state.

Recipient of 2022 STAND Award

We are thrilled to be one of the recipients of the Heartland Credit Union Association’s STAND Award during the 2022 Convention. STAND is a grassroots advocacy initiative that supports meaningful relationships between credit unions and lawmakers.

In order to qualify for the STAND award, the credit union must have a percentage of staff registered to be a member of the Army of Advocates and take action as an organization on at least 3 advocacy efforts throughout the year of 2022.

Thank you to all our employees who took a STAND this year!