About Tigers Community Credit Union

Cooperative banking is better banking

Founded by Students and Faculty

Tigers Community Credit Union was founded in 1984 by a group of MIZZOU students and faculty as “Missouri Student Federal Credit Union”. We were the first financial institution on the University of Missouri–Columbia campus.

We continue to live the mission and vision of these students and can say with great assurance, we have made them very proud.

Growing Up

Just like our founding students, Tigers Community Credit Union has grown up, left campus, and found success—but our hearts remain with Black & Gold. We remain a not-for-profit financial organization dedicated to serving the needs of MIZZOU students, alumni, faculty and staff at our 3 branches in Columbia.

Growing Strong

We embarked on a partnership with West Community Credit Union in 2006. With this addition, we've grown to serve Stephens College, Columbia College, plus anyone who lives or works in Boone County, St. Louis County, St. Charles County, Franklin County, Lincoln County, and St. Louis City.

In 2022, we opened our third location in Columbia, and in 2023, our eighth location in the Saint Louis area!

Today we are over $490 million in assets and serve over 32,000 members and businesses.

Credit Unions Are different than banks.

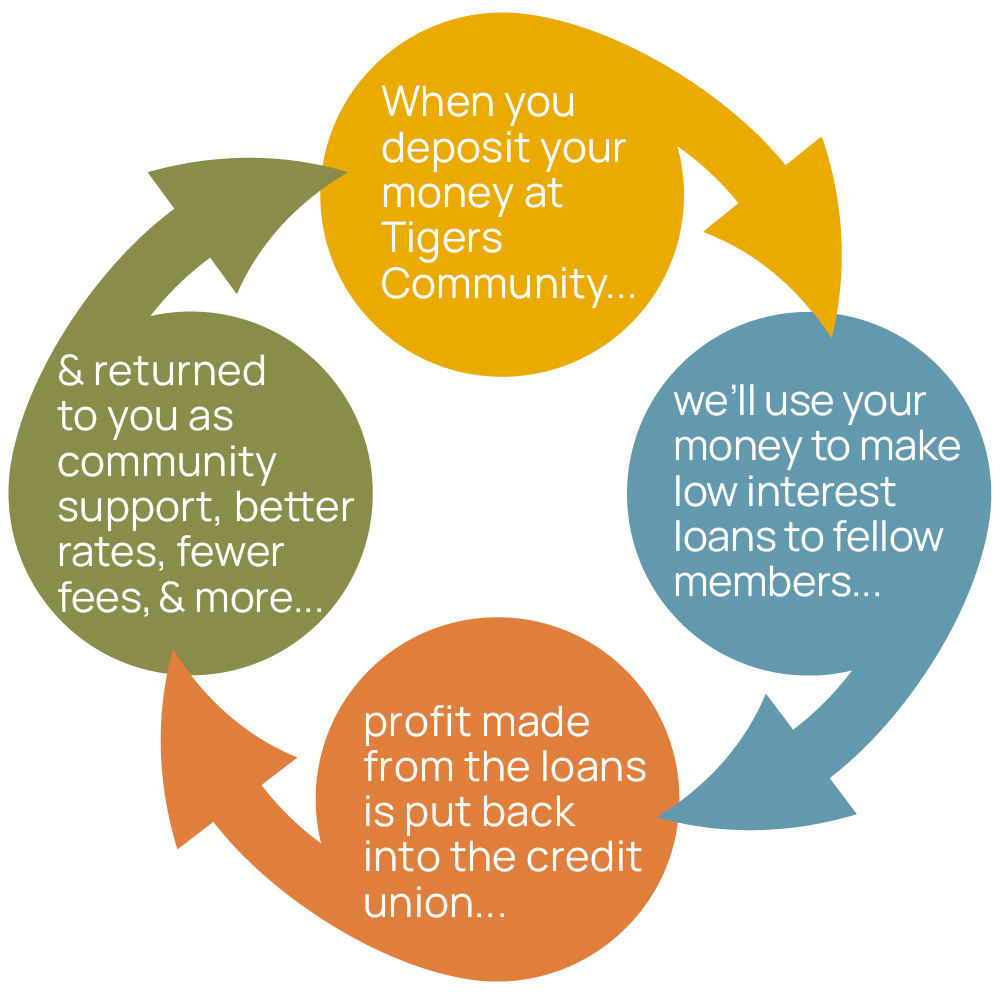

The Difference: Tigers Community Credit Union is owned by our account holders. Our members' financial success is our single goal.

Every traditional bank exists to make their stockholders rich. They achieve this by charging their customers as much as they can get away with in fees and interest, and giving the profits to their stockholders.

Bank customers generally pay more to have basic access to their own money, pay more to borrow, and earn less when they save.

Be an owner. Not a customer.

How We're Governed

Tigers Community is not obligated to make a profit for stockholders–we don’t have any! We are a not-for-profit financial cooperative, exclusively owned and governed by the people who use our financial services.

Our democratically elected, volunteer Board of Directors is comprised of Credit Union member-owners. They work to promote the financial well-being of their fellow members because, when a Tigers Community member succeeds, we all succeed.

That's why cooperative banking is better banking.

The Officers and Directors who serve on the Board, volunteer their time and expertise to establish policies and strategies that will help our financial cooperative grow.

An election is held annually for open positions in which members over 18 years of age can vote. Any member can volunteer to run for the Board of Directors, the Supervisory Committee, or a board committee.

We Serve As Good Stewards of Our Members' Money

Our sound policies and investment practices have helped keep Tigers Community strong, even in times of crisis for other financial institutions. Our products and technological capabilities are among the most secure and advanced available.

Your Deposits Are Insured For a Minimum of $1,000,000

Accounts are federally insured up to $250,000 by the National Credit Union Administration (NCUA). Plus, at Tigers Community we provide an additional $750,000 in private insurance from Excess Share Insurance (ESI). Learn more about your insured funds.

*America's Credit Unions, West Community Member Benefit Report. Rates and fees as of 4/3/2024. Assumes 2.1 credit union members per household. A "loyal member" is assumed to have a $30,000, 60-month new auto loan, a classic credit card with an average balance of $5,000, a $200,000, 30-year fixed rate mortgage (a 30-year fixed rate mortgage is replaced with a 5-year adjustable rate mortgage if it yields a greater benefit as it is assumed more in demand) , $5,000 in an interest-bearing checking account, $10,000 in a one-year certificate account, and $2,500 in a money market account.t.

BELIEVE IN YOUR DREAMS. WE DO.

At Tigers Community Credit Union, we believe in something bigger. Something that brings us all together. It’s the idea that we’re all connected, and that there’s a common good worth working for. We’re in the business of building relationships based on trust, being honest with our members, and treating everyone fairly.

OUR MISSION: To be our Members' lifelong financial partner by truly understanding their stories and delivering smart solutions.

Life is full of surprises and when something unexpected pops up, we’re always ready to help a

neighbor get back on track. We care about our members and we care about their goals. With smart,

thoughtful solutions, we help our members move forward in life. And we work hard every day to

deliver an exceptional experience for every member, every time.

We believe in people, our

members, and our community. We are Tigers Community Credit Union and we are banking on you.

Opening an account is easy!

We make it easy to take advantage of all Tigers Community Credit Union banking has to offer!

If you are affiliated with any of the following, you can open an account:

- MIZZOU, Stephens College and Columbia College students, faculty, staff, alumni, and student organizations.

- Anyone who lives or works in one of these locations:

-

- Boone County, MO

- Franklin County, MO

- Warren County, MO

-

- Lincoln County, MO

- St. Charles County, MO

- St. Louis County, MO

-

- St. Louis, MO

- Jefferson County, MO

- Sikeston, MO

- It's a family thing too! Anyone with a family member* living or working in any of the listed affiliations is eligible to join too. That family member doesn't even have to be a member with us.

Open an Account Today

Open your account online or visit your local branch.

Once a Member, Always a Member

When you join Tigers Community, your $5 initial deposit in a savings account is your share in the Credit Union making you both a member and owner. And once you’re a member, you’re always a member.

Find the branch closest to you and stop by. Our Member Representatives will be happy to help you open an account and start taking advantage of everything cooperative banking has to offer.

*A family affiliation is a parent, legal guardian, spouse, son, daughter, sibling, grandparent, grandchild, nephew, niece, uncle, aunt, first cousin, step, in-law and adoptive relationships.